Wealth Planning & The Over-Privileged Child

Updated on May 14th, 2020 | By Anthony Glomski  | Leave a Comment

| Leave a Comment

Key Takeaways:

-

Over-privileged children can create big problems—even tragedy—in their own lives, the lives of their family members, and even in the lives of strangers.

-

Getting help to address both the behavior and the negative outcomes of the actions can be crucial.

- Trusts, succession plans, and other strategies can help protect children from the dangers of easily accessible family wealth

We tend to work with first generation entrepreneurs who create wealth. A byproduct of their professional success is the complexity created in their personal life. Our role is to develop bespoke solutions to address that complexity. Top of mind to many of these first generation wealth creators is a major concern—I don’t want to mess up or harm my family as a result of this success.

Affluenza. First coined in 1973, it’s the term being used more and more to describe the negative—sometimes horrific—actions of over-privileged children in affluent families.

Never mind that it’s not an official medical diagnosis. The label unfortunately fits some kids today growing up surrounded by sizable family wealth and privilege.

If you’ve got one or more over-privileged children living under your roof, it may be time to take action—from correcting and preventing harmful behaviors to arranging your wealth in ways that quench the “affluenza fire.”

If you’ve got one or more over-privileged children living under your roof, it may be time to take action—from correcting and preventing harmful behaviors to arranging your wealth in ways that quench the “affluenza fire.”

Here are some of the best tactics we’ve seen to address the very real problem of over-privileged kids in Super Rich families (those with $500 million or more).

What Does Over-Privilege Look Like?

Over-privileged children tend to act recklessly without considering the consequences. Often this leads to them hurting themselves and their families because of addiction and/or violence. In other cases, their actions ruin the lives of many—such as when one affluent Texas teen killed four people in a well-publicized drunk-driving accident.

We’ve seen a growing number of these children in recent years, driven in large part by the burgeoning number of extremely wealthy families. More rich and Super Rich families (those with $500 million or more) are being minted these days than at any time in history. Assuming the same percentage of children of the ultra-wealthy act out and there are considerably more such families, there will be a significant rise in the number of over-privileged children.

Some of these kids’ actions appear on social media. But most over-privileged children are living out of the limelight—where they indulge to excess. They regularly are in conflict with the law, requiring their families to come to their rescue in one form or another.

Not surprisingly, they tend to be in their teens and 20s. When they are over the age of 30, they might lose the label “over-privileged children”—even though their actions and attitudes haven’t changed a bit.

Other key characteristics of over-privileged kids include:

- Second generation (or later scions) of extremely wealthy families throughout the world.

- Choose hedonism over hard work. In fact, many of them are seemingly striving to continually raise the bar on self-indulgent, pleasure-seeking behavior.

- Strong sense of entitlement.

- Often narcissistic and tend to look down on people with less wealth.

- Don’t believe society’s laws apply to them in the same way they apply to other people, in part because they’ve been rescued from difficult legal situations.

Unsure if you have an over-privileged child? Take the quiz at the end of this article to find out.

Who Is to Blame?

These kids are routinely given what they want, told they’re wonderful and special, and bailed out from their problems. The ensuing environment begs for entitled behavior.

But it’s not that simple. After all, many heirs to great fortunes have grown up in such environments and turned out to be diligent, responsible, industrious, and caring individuals. While a person’s upbringing plays a big role in the development of his or her thinking and behavior, over-privilege can be exacerbated when strong systems aren’t in place to curb it, and also by personality.

“The common argument that parents are to blame for their over-privileged children isn’t without some merit.”

CLICK TO TWEET

Addressing Problems Caused by Over-Privileged Children

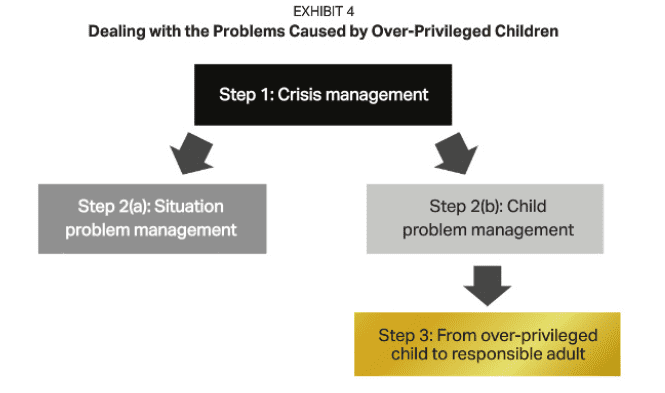

To manage over-privileged children, behavioral specialists advise a three-step process (see Exhibit 4).

Step 1: Crisis management. Immediate issues need to be addressed—especially if they present dangers to the child or others. For example, if the child was arrested, lawyers are required to arrange for bail or some other speedy solution. A public relations expert might even be called for. If there’s a way to alleviate damages, it should be evaluated and implemented quickly.

Step 2(a): Situation problem management. This is an extension of the previous step. The situation has been somewhat defused and action is being taken to mitigate the problems created by the over-privileged child. At this stage, some form of resolution is achieved. Often an expanded team of specialists is required.

Step 2(b): Child problem management. Next, the family takes action to get their over-privileged child help, if needed. Some corrective action should also be taken so the situation does not repeat itself. For example, in the case of drug addiction, the child might go to a rehabilitation center. Sometimes, the families are able to adjust the financials—making it difficult or impossible for the child to access funding when being destructive and harmful

A wealth planning professional should be adept at uncovering your specific needs and goals and bringing the appropriate solutions to the table—either by themselves or via their relationships with expert specialists. They should also explain the pros and cons of each approach. This is where AG Asset Advisory can help. If you find yourself in this situation, reach out to us.

Step 3. From over-privileged child to responsible adult. A long-term strategy should be created to help over-privileged children become stable, well-functioning, capable adults. This is not to say that they won’t make mistakes ever again. The aim is to help them avoid repeating harmful behaviors. Part of the solution may be to control their access to family money until they are able to make financial (and other) decisions maturely.

Managing the over-privileged children and the challenges they present can be complex—various experts may be needed throughout the process. We see an expanding set of professionals these days who are focused on helping wealthy families deal with problems when they arise. Psychiatrists, psychologists, clinical social workers, family consultants, family business consultants, and life coaches can all be valuable resources.

According to Babette Campbell, Business Management and Family Office Services Director at Armanino LLP, “Understanding the heart of these sensitive family issues is essential. Communication has to be on point to achieve the desired result. It requires trust, honesty and discretion.”

Access the Top 10 Wealth Planning Strategies for Successful Entrepreneurs

Access the Top 10 Wealth Planning Strategies for Successful Entrepreneurs

Wealth Management Aspects

Wealthy families with over-privileged children need to consider their assets carefully. Leaving money to a child who suffers from a terrible drug addiction, for instance, could be his or her death sentence.

From estate planning to asset protection planning, it is wise to understand the issues around wealth and over-privileged kids, and work to limit their ability to cause problems because of easy access to money.

There are a several wealth planning strategies that can be used to insulate the family and mitigate the impact of bad behavior. However, Campbell also notes that “there is diligence and cost associated with setting up protective entity structures, so you want to make sure the cost/benefit makes sense.”

Using trusts that have built-in oversight of an over-privileged child’s inheritance is a common and relatively easy way to protect the child and other people. Trusts may also help protect assets from creditors and others. Of course, the best way to use a trust will depend on the particular situation.

According to Jason Trenton, a top trust and estate attorney in the Los Angeles office of Venable LLP’s Tax and Wealth Planning Practice, “We often advise high net worth parents that if they’re going to let their kids know they are beneficiaries of family trusts, parents should tell kids that their beneficiary status is a “privilege” and not a “right.” If kids are not fiscally responsible and/or fail to lead productive lives, trust privileges can be revoked at any time. Alternatively, we utilize the privacy laws of trust-friendly jurisdictions, such as South Dakota or Delaware, and incorporate silent trust provisions in the trust document so the children aren’t even aware—and have no right to be aware—of the existence of family trusts, trust investments or their beneficiary status.”

In certain situations, the wealth planning becomes more specialized. If you have a family business and over-privileged children, for example, you have may have concerns about succession. Discussions of family wealth equalization can be difficult. Families should think through the various approaches and become comfortable with the probable outcomes. In my book, Liquidity and You: A Guide for Tech & Business Entrepreneurs Approaching an Exit, I discuss leaving your wealth to people you care about, which is critical to consider in this situation.

Warning: When it comes to expert wealth planning and over-privileged children, it’s not the actual wealth strategies and techniques that are most important. The most critical aspect to achieving the desired (and necessary) results is truly understanding what those results are, and effectively communicating the possible action steps.

If you feel your family and wealth are at risk from having an over-privileged child at home, reach out to us at AG Asset Advisory to discuss asset protection strategies that are right for your situation. We can also conduct a stress test on strategies you may already have in place.

Quiz: Is Your Child Over-Privileged?

To get a sense of whether your child may be over-privileged, answer this series of questions.

Round 1 Questions

When your child wants to buy the latest and most expensive tech gadgets, do you ever say no?

Would you have a problem if your child took a year off from college to tour the world in style?

If your child wanted a high-end sports car for his/her 18th birthday, would you give him/her any real pushback on that request?

If you answered “no” to any of these questions, it’s extremely likely that your child is privileged—that is, he or she has certain advantages due to the considerable wealth of your family. Your child is in a position to do things, buy things and live a lifestyle with limited concern for cost.

That doesn’t mean your child is over-privileged, however.

Round 2 Questions

Does your child consider himself/herself to be better than most other people because of your family’s social and financial standing?

Does your child need to and intend to ever work for money or for the good of others?

Does most everything revolve around your child and his/her intent on having a good time?

If your answers to these three questions are (respectively) yes, no and yes, your child might be something of a hedonist—and possibly not very nice to be around. That said, he or she may not necessarily be over-privileged.

Round 3 Questions

Does your child’s actions cause significant problems for himself/herself, you and other family members, or other people (or all three)?

When your child does cause severe problems, do you always come to the rescue?

If you answered yes to both questions, it’s time to stop and reflect. If a child comes by luxury with ease, is selfishly hedonistic, and acts in harmful ways—and you swoop in to save him or her from the consequences of bad actions—your child may very likely be over-privileged.

0 Comments

Submit a Comment

Meet Anthony

Anthony Glomski is the founder of AG Asset Advisory, an internationally recognized SEC-registered Family Office. His team works extensively with entrepreneurs so they don’t miss out on any potential opportunities and they get the results they want. This collaborative process addresses an array of family, financial, and lifestyle concerns along with coordination and oversight of various professionals to keep everyone focused tightly on their goals.

0 Comments

Submit a Comment

Work With Us

Contact:

Our Mission:

We design bespoke wealth planning strategies and customized solutions for highly successful entrepreneurs that avoid missing potential opportunities and achieve the outcomes you want.

Meet Anthony

Anthony Glomski is the founder of AG Asset Advisory, an SEC-registered Family Office. His team works extensively with successful entrepreneurs so they don’t miss out on any potential opportunities and get the results they want. This collaborative process addresses an array of family, financial, and lifestyle concerns along with coordination and oversight of various professionals to keep everyone focused tightly on their goals.